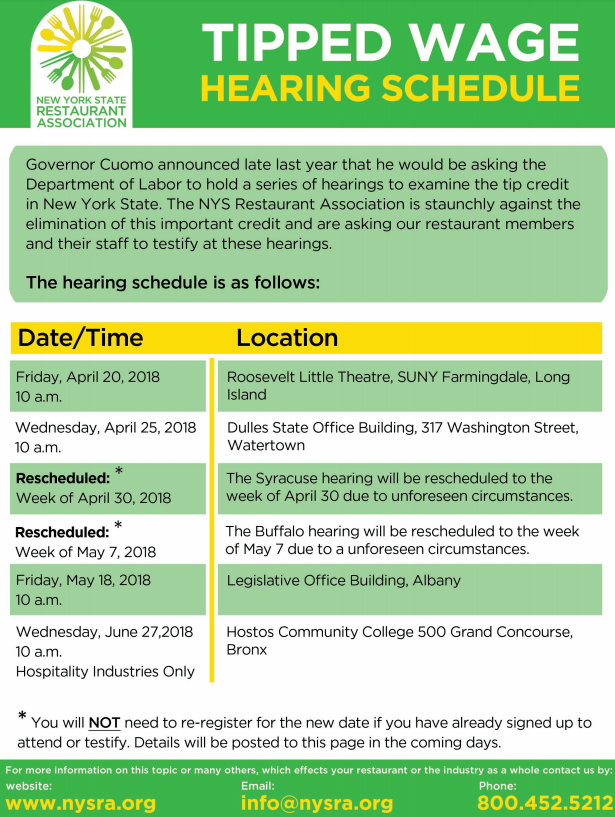

TIP CREDIT

New York State Governor Andrew Cuomo sent shocks waves through the restaurant industry by announcing that he will hold public hearings to examine if he should eliminate the tip credit. The tip credit allows tipped workers to be paid a lower minimum wage, as long as they earn at least the full minimum wage when their tips are included. If they don’t, the law requires that the employer pay the difference to the employee.

The tip credit helps New York City restaurants reduce their direct labor costs and survive in what many industry experts consider to be the most expensive and challenging business environment in the country. For example, a restaurant in Manhattan that generates $3 million in annual sales may spend up to $300,000 in wages for tipped employees. If New York State eliminates the tip credit, it would cost this restaurant approximately $160,000 in additional wages, taxes and workers’ compensation expenses. If this business is running a solid 10% profit margin, it will be chopped in half by more than 50%. Alternately, if the restaurant runs a 5% profit margin, they will land $10,000 in the red. And because restaurants are already receiving complaints from customers about increased menu prices, there doesn’t appear to be room to recoup this significant expense through additional price increases without ramifications.

Additionally, there are thousands of tipped employees throughout New York who make well in excess of the minimum wage. A New York City Hospitality Alliance survey of 486 city restaurants, which employ nearly 14,000 tipped workers found that those servers earn on average, $25 per hour.

By the end of this year, recent labor mandates for restaurants in New York City include a 100% increase in the tip wage. There will have been six consecutive annual minimum wage increases. The minimum weekly rate for salaried employees increased by $300. On top of that there was mandated paid time off and skyrocketing healthcare costs. These mandates have already resulted in increased menu prices for the consumer and exacerbated the disparity of income between tipped employees and kitchen workers, who are prohibited by law from earning a fair share of the tips. Restaurateurs will tell you that they have cut workers’ hours, eliminated jobs and even shuttered restaurants. And according to a recent report, 80% – 90% of restaurant jobs in New York City are subject to automation.

For these reasons, it’s no surprise that tipped restaurant workers worry that employers would be forced to reduce their hours and eliminate jobs due to the increased expense and that the increased menu prices needed to cover the costs would result in fewer customers and less take home pay because diners would leave smaller tips. Also resulting in lower wages, restaurants may switch to a no tipping business model as a way to control costs.

Source: Forbes

PAID SICK LEAVE UPDATE

Beginning May 5, 2018, NYC expands paid sick leave law. NYC employees may take leave when they or a covered family member has been the victim of a family offense matter, sexual offense, stalking, or human trafficking.

CREDIT CARD MINIMUMS:

NYC Councilmen Ritchie Torres and Andrew Cohen introduced a bill that would prohibit businesses in the city from setting a minimum greater than $10 for credit card purchases. If it’s passed in its current form, the proposal would levy hefty fines for businesses in violation and force shops to post proper signage when they do have a credit card minimum. Despite the proposed restrictions on credit card minimums, the law would not affect cash-only businesses, a spokesperson from Torres’ office said. But in the bill’s current language, there is no specific protection for cash-only businesses—that may change as it moves through the City Council.

Source: TimeOut New York

NYC COMMERCIAL BIKE REGULATIONS:

The NYC Department of Transportation has made some adjustments to the regulations regarding commercial bike use in the City. The Association supports these changes as they protect restaurants from 3rd party delivery services that may not be following all the laws that they should be. The new amendments include:

-

A new definition of “bicycle operator” that means a person who delivers packages, parcels, papers or articles of any type by bicycle on behalf of a business using a bicycle for commercial purposes and who is paid by such business.

-

An expanded definition of ”business using a bicycle for commercial purposes”, which to include any entity that either on behalf of itself or others delivers packages, parcels, papers or articles of any type by bicycle.

-

A requirement to register with NYC DOT if a business using a bicycle for commercial purposes does not have a site within NYC that is open and available to the public.

-

A requirement for a business using a bicycle for commercial purposes to ensure the availability of helmets for each of its bicycle operators. Such business may not require any of its bicycle operators to provide helmets and required bicycle equipment at the bicycle operator’s expense.

-

A requirement for bicycle operators to complete a bicycle safety course prior to making deliveries or otherwise operating a bicycle on behalf of a business using a bicycle for commercial purposes.

-

A metal or plastic identification sign is no longer required to be affixed to the rear of each bicycle.

As a reminder, the following rules still apply to the Commercial Cyclist Law:

-

A Business Using a Bicycle for Commercial Purposes are Required to:

-

Make available at the site the Commercial Bicyclist Safety poster.

-

Maintain a roster listing each delivery cyclist and date of course completion.

-

Provide commercial cyclists with: an ID card, a helmet, and a retroreflective vest.

-

Equip all bicycles used for commercial delivery with: a bell, a front white and red tail light, and working brakes.

-

-

Commercial Bicyclists are Required to:

-

Follow all traffic rules on the road, stay off sidewalk, signal when turning

-

Wear a helmet, use a bell, use lights after dusk/before dawn, only use one ear bud if wearing headphones

-

Note: Electric bicycles are not capable of being registered by the New York State Department of Motor Vehicles and therefore their operation is prohibited in New York City.

Source: NYSRA

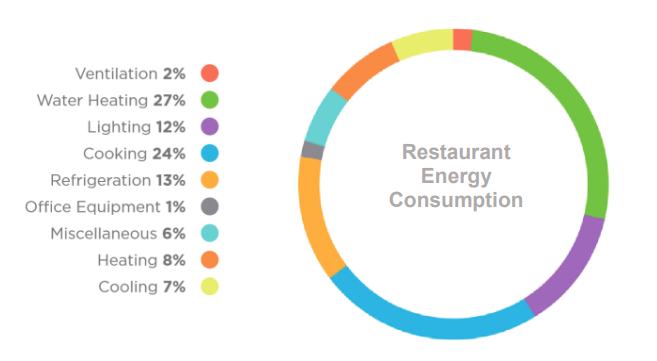

RESTAURANT ENERGY EFFICIENCY

This is easier than you may think. There are many simple changes you can make to promote sustainability. This article will point out some of our most effective strategies such as:

-

Purchase Electricity and Natural Gas

-

Retrofit your facility to LED light bulbs.

-

Turn off lights

-

Wash table linens in cold water

-

Invest in a programmable thermostat

-

Cover pots and pans while cooking and many more.

Source: NYSRA

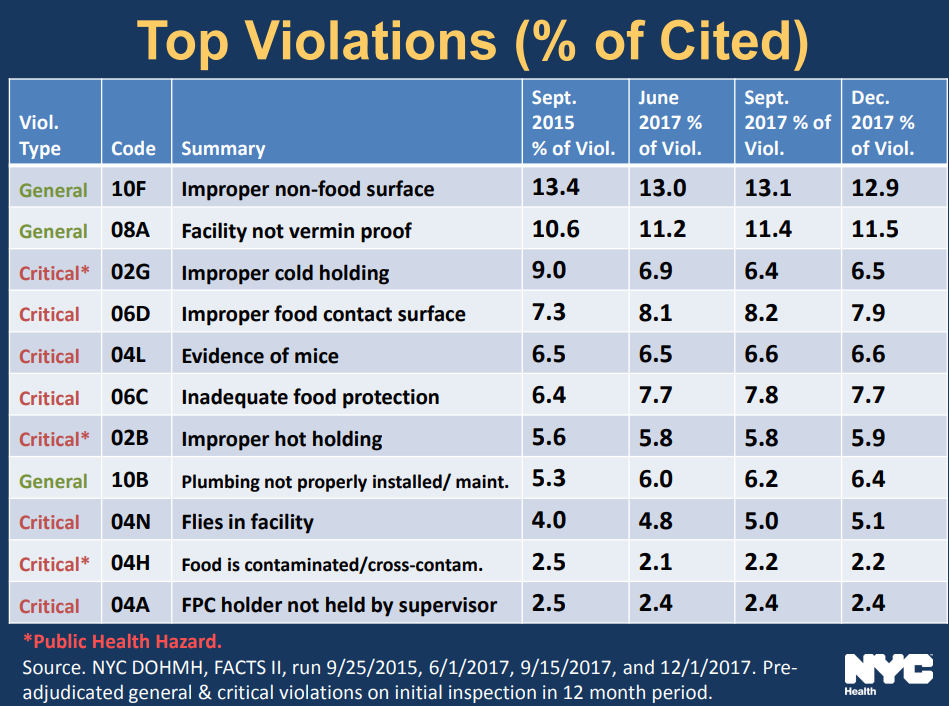

TOP HEALTH CODE VIOLATIONS OF 2018

Source: NYSRA